Can You Claim Church Donations On Your Taxes . However, there are limitations on how much of that. donations are only tax deductible if they are made to a government approved charitable organisation or directly to the government; you can only deduct a donation to a church if you itemize your personal tax deductions on irs schedule a. when donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions. gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. if your faith requires that you tithe a certain percentage of your income, you may be able to work with your church leaders to make lump. The amount of charitable donations you can deduct may range from 20% to. you can donate 100% of your yearly income to any church.

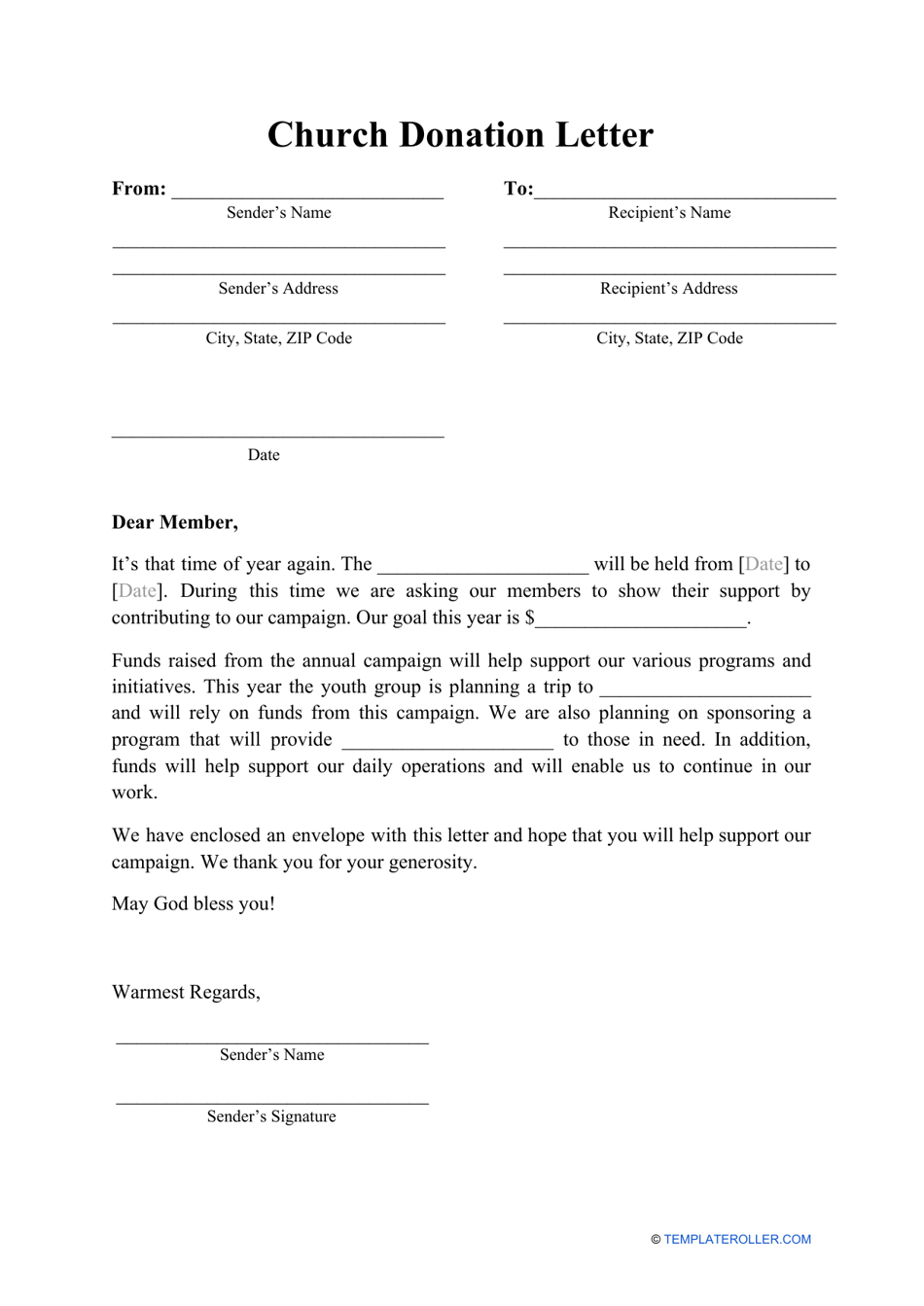

from www.templateroller.com

if your faith requires that you tithe a certain percentage of your income, you may be able to work with your church leaders to make lump. you can only deduct a donation to a church if you itemize your personal tax deductions on irs schedule a. gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. However, there are limitations on how much of that. you can donate 100% of your yearly income to any church. The amount of charitable donations you can deduct may range from 20% to. when donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions. donations are only tax deductible if they are made to a government approved charitable organisation or directly to the government;

Church Donation Letter Template Fill Out, Sign Online and Download

Can You Claim Church Donations On Your Taxes if your faith requires that you tithe a certain percentage of your income, you may be able to work with your church leaders to make lump. The amount of charitable donations you can deduct may range from 20% to. gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. if your faith requires that you tithe a certain percentage of your income, you may be able to work with your church leaders to make lump. However, there are limitations on how much of that. when donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions. you can donate 100% of your yearly income to any church. you can only deduct a donation to a church if you itemize your personal tax deductions on irs schedule a. donations are only tax deductible if they are made to a government approved charitable organisation or directly to the government;

From donorbox.org

Are Church Donations Tax Deductible? Can You Claim Church Donations On Your Taxes However, there are limitations on how much of that. when donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions. you can donate 100% of your yearly income to any church. if your faith requires that you tithe a certain percentage of your income, you may be able to work with your. Can You Claim Church Donations On Your Taxes.

From charlotteclergycoalition.com

Church Donation Letter For Tax Purposes charlotte clergy coalition Can You Claim Church Donations On Your Taxes donations are only tax deductible if they are made to a government approved charitable organisation or directly to the government; if your faith requires that you tithe a certain percentage of your income, you may be able to work with your church leaders to make lump. gift of money or cost of contribution in kind for any. Can You Claim Church Donations On Your Taxes.

From www.icsl.edu.gr

Can You Claim Protection On Tax Can You Claim Church Donations On Your Taxes gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. you can only deduct a donation to a church if you itemize your personal tax deductions on irs schedule a. The amount of charitable donations you can deduct may range from 20% to. if your faith. Can You Claim Church Donations On Your Taxes.

From templatediy.com

Church Donation Receipt Template Printable in Pdf, Word Can You Claim Church Donations On Your Taxes when donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions. However, there are limitations on how much of that. if your faith requires that you tithe a certain percentage of your income, you may be able to work with your church leaders to make lump. you can only deduct a donation. Can You Claim Church Donations On Your Taxes.

From donorbox.org

Are Church Donations Tax Deductible? Can You Claim Church Donations On Your Taxes when donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions. you can only deduct a donation to a church if you itemize your personal tax deductions on irs schedule a. The amount of charitable donations you can deduct may range from 20% to. gift of money or cost of contribution in. Can You Claim Church Donations On Your Taxes.

From jerseystrife.blogspot.com

Sample Church Donation Receipt Letter For Tax Purposes Darrin Kenney Can You Claim Church Donations On Your Taxes donations are only tax deductible if they are made to a government approved charitable organisation or directly to the government; you can donate 100% of your yearly income to any church. gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. The amount of charitable donations. Can You Claim Church Donations On Your Taxes.

From wealthfit.com

How to Maximize Your Charity Tax Deductible Donation WealthFit Can You Claim Church Donations On Your Taxes you can donate 100% of your yearly income to any church. The amount of charitable donations you can deduct may range from 20% to. you can only deduct a donation to a church if you itemize your personal tax deductions on irs schedule a. gift of money or cost of contribution in kind for any approved project. Can You Claim Church Donations On Your Taxes.

From www.youtube.com

Tax Relief on Donations to Charity Part 1 YouTube Can You Claim Church Donations On Your Taxes gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. if your faith requires that you tithe a certain percentage of your income, you may be able to work with your church leaders to make lump. you can only deduct a donation to a church if. Can You Claim Church Donations On Your Taxes.

From donorbox.org

How To Write Effective Church Donation Letters [Free Templates] Can You Claim Church Donations On Your Taxes you can donate 100% of your yearly income to any church. if your faith requires that you tithe a certain percentage of your income, you may be able to work with your church leaders to make lump. donations are only tax deductible if they are made to a government approved charitable organisation or directly to the government;. Can You Claim Church Donations On Your Taxes.

From www.emetonlineblog.com

Printable Printable Church Donation Receipt Template For Religious Can You Claim Church Donations On Your Taxes However, there are limitations on how much of that. gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. you can donate 100% of your yearly income to any church. when donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions.. Can You Claim Church Donations On Your Taxes.

From donorbox.org

Encourage Repeat Donations to Your Church QuickDonate Can You Claim Church Donations On Your Taxes if your faith requires that you tithe a certain percentage of your income, you may be able to work with your church leaders to make lump. However, there are limitations on how much of that. donations are only tax deductible if they are made to a government approved charitable organisation or directly to the government; when donated. Can You Claim Church Donations On Your Taxes.

From www.sampleforms.com

FREE 5+ Church Donation Forms in PDF Excel Can You Claim Church Donations On Your Taxes when donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions. However, there are limitations on how much of that. you can only deduct a donation to a church if you itemize your personal tax deductions on irs schedule a. The amount of charitable donations you can deduct may range from 20% to.. Can You Claim Church Donations On Your Taxes.

From charlotteclergycoalition.com

Church Donation Letter For Tax Purposes Template charlotte clergy Can You Claim Church Donations On Your Taxes gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. you can donate 100% of your yearly income to any church. you can only deduct a donation to a church if you itemize your personal tax deductions on irs schedule a. donations are only tax. Can You Claim Church Donations On Your Taxes.

From dl-uk.apowersoft.com

Printable Church Donation Receipt Template Can You Claim Church Donations On Your Taxes when donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions. donations are only tax deductible if they are made to a government approved charitable organisation or directly to the government; if your faith requires that you tithe a certain percentage of your income, you may be able to work with your. Can You Claim Church Donations On Your Taxes.

From peregianspringsss.eq.edu.au

Tax deductible donations Can You Claim Church Donations On Your Taxes when donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions. donations are only tax deductible if they are made to a government approved charitable organisation or directly to the government; you can only deduct a donation to a church if you itemize your personal tax deductions on irs schedule a. . Can You Claim Church Donations On Your Taxes.

From jerseystrife.blogspot.com

Sample Church Donation Receipt Letter For Tax Purposes Darrin Kenney Can You Claim Church Donations On Your Taxes The amount of charitable donations you can deduct may range from 20% to. donations are only tax deductible if they are made to a government approved charitable organisation or directly to the government; when donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions. if your faith requires that you tithe a. Can You Claim Church Donations On Your Taxes.

From www.globalgiving.org

Everything You Need To Know About Your TaxDeductible Donation Learn Can You Claim Church Donations On Your Taxes The amount of charitable donations you can deduct may range from 20% to. However, there are limitations on how much of that. you can only deduct a donation to a church if you itemize your personal tax deductions on irs schedule a. if your faith requires that you tithe a certain percentage of your income, you may be. Can You Claim Church Donations On Your Taxes.

From www.jotform.com

Church Donation Receipt Template PDF Templates Jotform Can You Claim Church Donations On Your Taxes if your faith requires that you tithe a certain percentage of your income, you may be able to work with your church leaders to make lump. you can donate 100% of your yearly income to any church. The amount of charitable donations you can deduct may range from 20% to. you can only deduct a donation to. Can You Claim Church Donations On Your Taxes.